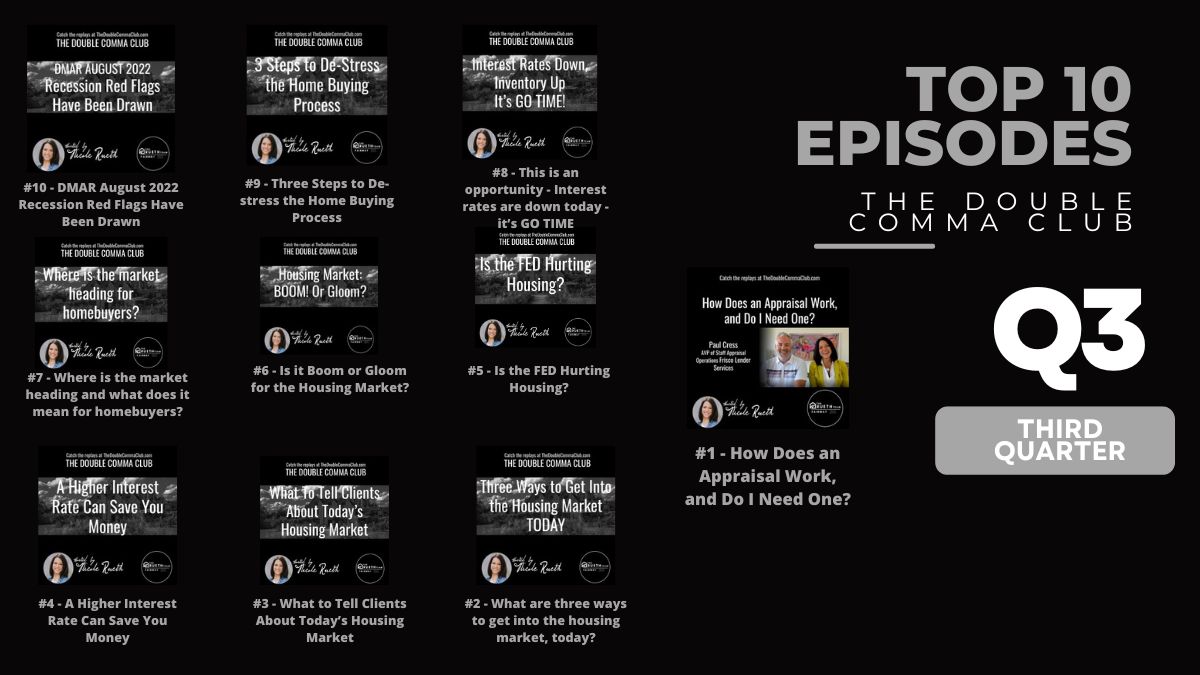

#10: DMAR August 2022 Recession Red Flags Have Been Drawn

A recession is always coming, it’s just a matter of time. It’s purely the nature of a cyclical economy. “Are we in a recession” searches continue to hit record levels on Google, and talk of a housing recession has some counting on the bubble to burst. With more inventory and all other numbers lower across the board, it’s starting to look like a recession, or, maybe it’s just the slowdown we’ve all been hoping for.

A recession does not equal a housing bubble. While there will be layoffs, slowed production, and a softening in consumer spending, Americans are coming into this recession with $2 trillion in savings and twice the home equity there was in 2006. Colorado is also protected by having 38% of homes owned free and clear, only 1.7% of mortgaged homes delinquent, and a current foreclosure rate of 0.1%. If home prices continue to slow, as I expect they could during the second half of 2022, recent buyers might lose a little value, some homeowners might even need to sell quickly, but most will simply not sell. Knowing that as rates drop, as they consistently do during recessions, pent-up demand will reengage with our limited supply, forcing multiple bids and yet again higher prices.

Institutions, first-time home buyers, and those who have been waiting will all be ready to buy on these dips. And since we have not yet achieved an inventory level that could comfortably sustain a surge in demand, the thought of a housing bubble eludes me.

#9 – Three Steps to De-stress the Home Buying Process

1. Lock and Shop

This is where you can hold the rate for 90 days, with the option to extend it for 30 more while you are under contract. If rates go up, you are locked in, if they go down, we can renegotiate the rate.

2. TBD Underwrite

This goes hand in hand with Lock and Shop. We gather all of your information, submit it to an underwriter, and then you can be fully underwritten and are viewed as being the same as a cash offer. Some of these transactions are closed in 8-10 days.

3. Knowing Your Needs vs. Wants

Once you have that defined and the first two steps handled, you can move quickly to secure your home.

#8 – This is an opportunity – Interest rates are down today – it’s GO TIME

Rates Down, Inventory Up, Holiday Weekend… GO TIME! The 10-year treasury surprised me this morning.

Listen to this and you will have 5 options of how to take advantage of the sudden drop in interest before the wave goes back up.

#7 – Where is the market heading and what does it mean for homebuyers?

We are still seeing a lot of market volatility and with the FED meeting this week, everyone is praying that they will just control inflation! But, interest rates DROPPED. There is a window of opportunity to take advantage of as a homebuyer, and we have a program that can help you lock in at these lower rates!

While you’re at it, look at gas prices and go fill up, TODAY!

#6 – Is it Boom or Gloom for the Housing Market?

What’s Next for the Housing Market? Is it BOOM OR GLOOM?

We’ve experienced an incredibly volatile housing market over the last two years. It was full of huge equity gains, rising home prices, and little inventory. So, what’s next for the housing market?!

Is the housing market going to crash? Will we enter into a recession? What happens to housing in a recession? Is now still a good time to buy a home? I hope this episode answers a lot of your questions and will help show you that the housing market is still strong!

#5 – Is the FED Hurting Housing?

Fed Chair Powell stated the Fed is creating a “bridge period” of “demand exhaustion”. This is being interpreted as the Federal Reserve is killing the housing market. I get it. But what I see is first-time home buyers getting the reset, the break they’ve been needing and asking for. Plus, with the housing market as strong as it is… it’s hard to justify a bust coming. I guess it’s all how you look at it.

Please know: The Fed Rate and mortgage rate are not sisters, but they are cousins.

This is what’s been happening with the greed of home sellers, the FHFA, and banks.

- Buyers are struggling more so than ever before.

- Cancelations have gone way up because of the higher interest rates.

- Policies have come out that devastated pricing.

- There is an increase of inventory – double of last year – but it’s way below normal balanced markets.

We’re not going to see a massive drop in prices, people will just stop selling.

It’s all about perspective. Buyers have to be reminded of the strength in our housing market and that there is still opportunity!

#4 – A Higher Interest Rate Can Save You Money

know higher interest rates are stressing affordability and pushing buyers to sit on the fence. But, what if I told you that a higher rate could actually SAVE CLIENTS’ MONEY? You’d probably think it’s a trick! But it’s not, it’s perspective.

You are marrying the house,

but you are dating the rates.

*CORRECTION… The comparison rate used in my calculation from March of 2021 with the $675,000 loan amount was 4.625% not 4.25%. My apologies for my error; but my position on perspective stands.

#3 – What to Tell Clients About Today’s Housing Market

In a tough market flooded with negative headlines, it can be an uphill battle trying to convince clients that now is still a good time to buy!

The truth is that we don’t know when a recession will happen, or what the extent will be? How much further interest rates will rise? When they will fall? How much will they fall? The list goes on and on. And it’s scary, I get that. The unknown always is. But here’s what we do know:

- Housing goes up in the long term

- There are refinance opportunities when rates come down

- Owning real estate gives you financial stability and opens up options in the future

Don’t forget to join Agent Ignite https://www.theruethteam.com/agents/ignite-training/

#2 – What are three ways to get into the housing market, today?

There’s so much strength and opportunity in our housing market today, but many buyers are still struggling to get in. Home prices are going up, along with rents, and interest rates remain in flux. But, you can’t time the market! Purchasing a home is a big commitment, but buyers have to be able to see the long-term benefits that come with home ownership. Three ways YOU can get into the market TODAY are: 1) Down Payment Assistance 2) Gifts 3) Renovation Loans.

#1 – How Does an Appraisal Work, and Do I Need One?

Another question in this episode is, “What if there’s a grow house in the garage?” The guidelines for appraisals vary depending on who the lender is, whether it’s Fannie, Freddie, VA, FHA, or Conventional. Nicole’s guest is Paul Cress, AVP of Staff Appraisal Operations for Frisco Lender Services (FLS).

Nicole asked him, “So what brings that volatility, and what eases it overall?”

Paul told her, “Lately the reason it’s eased is that interest rates have dropped, demand. It’s simple supply and demand. Realistically, over the past three years, property values have risen more than they have at any other time in history. That’s due to increased demand and decreased supply. It’s caused quite a market stir where realistically, the purchase demand can’t be caught up with, and appraisals are done in retrospect, they’re a flash in time. And when you’re looking back even weeks or days, and trying to keep up with this market, that’s increasing day over day. That’s what really caused the stir in the market and values to become undervalued or, become under what the contract price was.

Nicole pressed, “If I have a buyer willing to pay an amount of money for a house, even if it’s over asking price, isn’t that the market value?”

You’ll have to tune in to hear his answer, the issue of ADUs, grow rooms, and how much adding a rental unit can add to your home value.