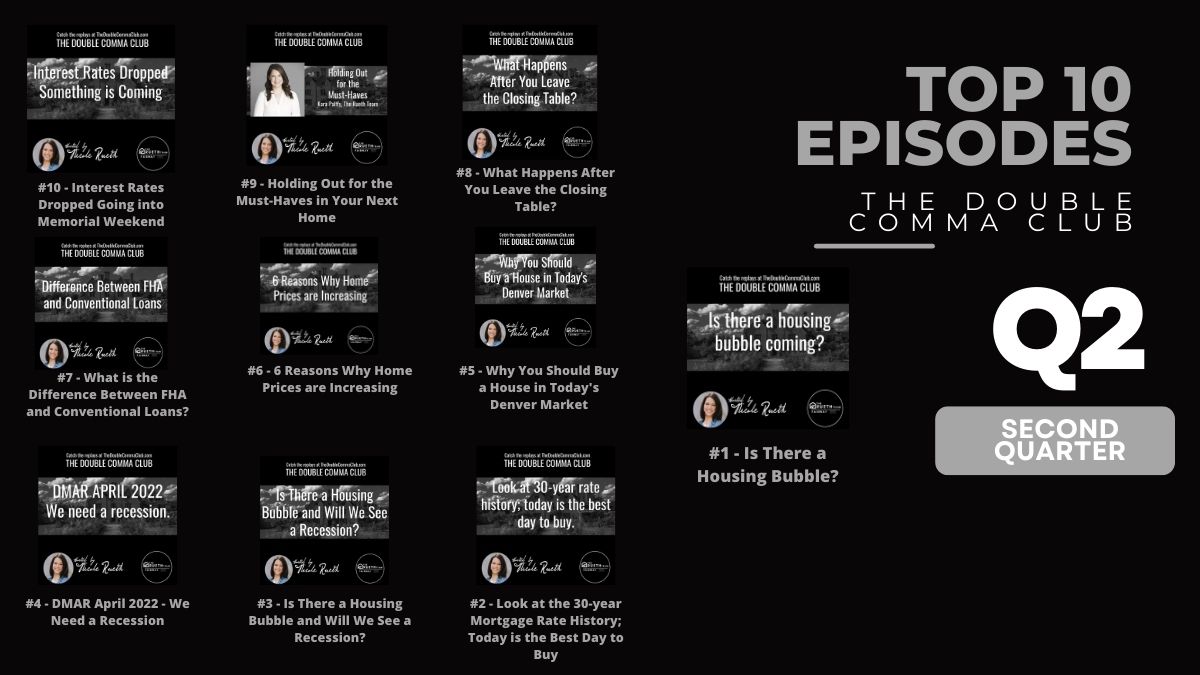

#10 – Interest Rates Dropped Going into Memorial Weekend

It’s not Tuesday, but I’ve got news that I want to share. And I know I’ve got market trends tomorrow, but rates went down, and I need to know that, you know, that especially going into Memorial Day weekend, how much did they go down? Why did they go down? And are they going to go down further? I mean, that’s the question, right? Because is this a new trend or is this just a blip? And it’s really critical that we jump in because I know something’s coming, we all feel it. And I’m going to be talking about this at tomorrow’s Market Trends Update. What are all the indicators that are pointing us clearly towards an economic slowdown? And that economic slowdown is more than likely going to come with a reduction in interest rates, which is going to give us an opportunity to refinance. But almost more importantly, it’s going to spark more demand.

#9 – Holding Out for the Must-Haves in Your Next Home

It’s one thing for an expert to tell you what you should do when investing in a home, refinancing, and selling. But when you have an opportunity to hear a real start to finish story from a home buyer to held out for the full must-have list and then successfully purchased a home in the Denver market, you will be riveted. Kara Palffy is Nicole’s guest. She’s the Business Development Manager at The Rueth Team. Buying her second home, selling the first, and all of the hours required make for the best kind of story. Nicole asks Kara about what she had to do to prep her home, how much they actually got over asking, why they decided to NOT add to their real estate empire and sell their first house instead, and how their goal of staying in this home for many years affected several decisions.

#8 – What Happens After You Leave the Closing Table?

You just spent a lot of time, effort, and money getting into your new home… but what’s next? There are some important things to take note of in the months following closing day such as:

- Your first mortgage payment

- HOA Payments

- Utilities

- Home renovations

#7 – What is the Difference Between FHA and Conventional Loans?

And do you know which is better for you? I don’t believe that one of these loan programs is ‘better’ than the other. However, I do believe that one may work better for YOU. FHA and Conventional Loans each bring something different to the table, thus working better for one type of buyer over the other. You don’t need to know the hyper-specifics of each program, that’s what we’re here for. But it can be helpful to have a basic knowledge and ask your mortgage lender the right questions. Listen to this 7-minute episode of The Double Comma Club, “What is the difference between FHA and conventional loans?”

#6 – 6 Reasons Why Home Prices are Increasing

It’s no secret that the real estate market, ESPECIALLY in Denver, has seen a dramatic increase in home prices. According to CoreLogic, the national median home price grew at an all-time high 18.8% year-over-year in December 2021. Homebuyers are feeling the rise in costs of EVERYTHING, and the increased home prices are not going away anytime soon. The cost of waiting is extreme! It’s time to get off the fence and into a home. Be sure you give my team a call and let’s come up with a strategy that begins building long-term wealth through real estate.

Nicole goes into details in this 14-minute episode about each of the reasons:

1) Artificially low mortgage rates during the pandemic

2) Low housing supply

3) Millennial household growth

4) Inflationary actions by the FED

5) Building costs & inflation

6) FOMO

#5 – Why You Should Buy a House in Today’s Denver Market

Buy NOW to have options later. Real estate is still the number one hedge against inflation and the potential to build long-term wealth is still there!

Although the real estate market is tough right now, you have to get in in order to build long-term wealth, earn appreciation, use the equity you’ve built for a renovation or a move up and you can always refinance once things calm down.

Your long-term goals can be achieved through owning a home and we want to help you get there. As always, don’t hesitate to reach out if you’re ready to start or complete your homebuying journey.

#4 – DMAR April 2022 – We Need a Recession

A recession is exactly what we need right now. And it’s good for housing. So what am I talking about? The two in tenure treasury yield had a small 0.05 spread as March ended. This is on the verge of inverting, which is a high validity recession indicator of five of the last six recessions that were all proceeded by an inversion. However, today we also have incredibly strong labor market. The unemployment number just came out at 3.6%, which is a post-pandemic low. In fact, unemployment has only been lower than 3.6%, three times since 1950 non-farm payroll saw robust 431,000 jobs added, which is alongside 11.3 million job.

If you remember an inventory in 2018, when rates pushed above 5%, 1,827, new listings came on the market during March that’s a 44% month of a month increase, but more than half of those new listings were scooped up as pendings increased by 1039 and closed homes increased by 941.

While more inventory might give buyers a little more breathing room, they are not giving up with more inventory. We have more sales. This additional inventory is partially due to seasonality. I mean, some of it is investors taking their winnings off the table and others are looking at this intense demand and talks of a bubble and wanting to play the timing game. I think as prices rise, high prices are a bit of a cure for high prices. The appreciation much like inflation will slow down, but talks of a bubble assume high prices themselves are the tipping point and they aren’t homeownership, equity of 69.2%, a vacancy rate of 1.6% and a high birth rate. 30 to 33 years ago, all starve off the bubble talks 75,000 annual equity gain for an average Colorado. In addition to a 0.01% Colorado foreclosure rate, and a 1.9% 30 day rate tells me that struggling homeowners don’t have to sell at a discount just at market.

#3 – Is There a Housing Bubble and Will We See a Recession?

We’ve again been flooded with headlines on the impending doom of a housing market crash. As homebuyers right now, it can be hard not to fall into the trap of waiting. I get it. There’s a flood of information being thrown at you, but this video will help cut through the noise.

- First, there is NO bubble. We simply have too much demand, insane equity built up in our homes and a HIGHLY QUALIFIED pool of buyers entering the market.

- Second, a recession is OK. A recession is defined as 2 consecutive months of GDP Decline… that’s it. As prices of everything continue to rise, consumers will start to make decisions; spending less, saving more, pushing GDP down. This will allow the supply we all desperately crave to CATCH UP to demand, giving buyers more options!

- Third, a Refinance is your best friend. We don’t know exactly what the market will do tomorrow, or one week from now, or a few months from now! Lock in the here and the now, and start building long-term wealth through real estate.

#2 – Look at the 30-year Mortgage Rate History; Today is the Best Day to Buy

Interest rates just hopped up again! The market today remains an extremely volatile place and is in a constant tug of war with the FED, unemployment rates, inflation, the war and all other factors! So, is it still a good time to buy a home? My answer remains the same as the Denver market continues to build equity, financial security, and supports our highly qualified buyers. Here are a few things you should know heading into this weekend.

#1 – Is There a Housing Bubble?

Will the housing market crash in 2022? Here is your DMAR Real Estate Market Update. The real estate market is INTENSE right now, and news headlines are doing a very good job of scaring us into thinking that we are heading towards a housing bubble burst. But the truth is, there is NO BUBBLE.

Yes, interest rates and prices are rising, but the amount of equity and demand we are seeing DOES NOT constitute a bubble ready to burst. If anything, a little slow down in market activity will give supply a chance to catch up, giving homebuyers more options.

I encourage you to always take a look at the facts, and keep an open dialogue with yourself, your realtor and your lender on your affordability and expectations in the housing market.